'Dreams Do Come True'

A MIRIAN from Tudan who works for a shipbuilding company, has embarked on more than a decade-long quest to build a proper brick house for his family.

It was a dream that appeared to be slipping from his grasp over time as his health started to decline with age.

It may not seem like much but for John anak Away, building their dream home was a promise he, as the provider, made to his wife, two sons and a daughter.

The couple worked tirelessly to provide a safe and comfortable home for their children.

While John was trying to save enough money to realise his dream, things took a sad turn when his wife suffered a stroke in 2009, paralyzing her from the waist down.

This effectively made John the sole breadwinner. His family was then living in a small wooden house.

Ever determined, John refused to throw in the towel and though not a house builder, he took the time to learn the ropes from construction workers and spent whatever money he could save to buy building materials.

John was resolute in his decision to build his dream home by himself. He invested time in learning to draw the building plan, making sure the foundation was properly laid.

The groundwork included piling (by hand), levelling the concrete and building the support beams, using materials bought with his meagre salary.

John would spend weekdays working and weekends on building his house. He often toiled under the sun and knowing every brick laid brought him a step closer to his dream spurred him on. The thought of his wife’s condition steeled his resolve.

Facing reality

But reality is unlike the invariable “live happily ever after” ending of fairytales.

Lamented John: “Building materials such as concrete, bricks and sand aren’t cheap and their prices keep going up. My wife and I spent all our EPF buying building materials for the house.

“I also had limited quality time with my family as I spent most of my free time building. But I’m glad they understood I was doing it for them.”

In the face of adversity, John displays a spirit one hears about in motivational stories — a true Sarawakian grit of “agi idup agi ngelaban” whereby, despite the challenges, he will plod on with a brave heart to achieve his goal.

His son, not wanting him to shoulder the burden alone, is now working to help the family out.

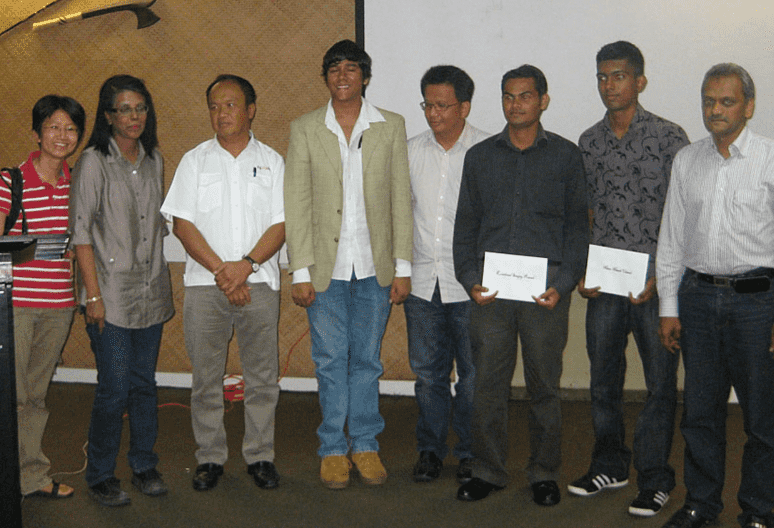

Volunteers join hands to build the house.

John is proud of his boy, currently being trained for a potential management position.

With age catching up and his health declining due to increased asthma attacks, John’s cherished dream of building a new home for his family seemed to be slipping away at one point.

“I felt with my health condition, the dream of having this house built would have to be continued by my son as I didn’t know then how much longer I could keep this up,” he shared.

Unique CSR effort

As fate would have it, Naim Group of Companies had embarked on a unique Corporate Social Responsibilty (CSR) effort under Naim ‘Better Homes Project’ to build or complete building the dream homes of selected needy members of the community.

The CSR project was part of the Group’s 25th anniversary programme focusing on community engagement and enhancement.

Working closely with the Sarawak Welfare Department, the Group came up with a list of potential candidates with John as one of the likely beneficiaries.

A combined team from the Sarawak Welfare Department and Naim went to the ground to meet the list of hopefuls. One stood out – a quiet simple man in torn work clothes who rushed home on hearing a group of people from the government and Naim wanted to meet him.

Shy but polite, holding an honest smile as he picked up his grandson at the door of his wooden house, John greeted the delegation who told him the good news.

Point of health

On his heath, John made it clear that as long as he is able, he would continue to provide for his family.

Asked what sort of assistance he needed, his reply was modest: “If anyone is willing to provide some construction materials, I will build the rest of the house myself.”

A far cry from some who openly ask for direct monetary aid.

After an evaluation, a team from Naim, led by Abang Mahathir Mohamad, the regional general manager for Miri, dropped by to tell John his strength of character did not go unnoticed and Naim had selected him as the recipient of its new CSR initiative.

John, holding back tears while hugging his grandson, was quick to express his gratitude.

“I’m lost for words. Knowing the house I promise my family will be completed seems so unreal. It’s truly a prayer answered when Naim reached out to me and picked me as the beneficiary of this programme,” a misty-eyed John said.

Naim wasted no time getting down to work. The goal was to have the house built within a month — in time for John to celebrate Christmas with his family in their new home.

With Naim contributing the building materials, a slew of volunteers, including Naim staff and contractors, joined hands in a race against time to complete building John’s house.

Naim’s Group deputy managing director, Christina Wong who also volunteered, said businesses would not be successful when the society around them failed.

Giving back

“The support of our communities helps us to become what we are today. Hence, it’s only right to give back to needy community members. We’ve never forgotten our corporate social responsibility throughout our 25 years of existence.

“We’re also looking into building more affordable housing for our communities in response to the government’s call for more private sector involvement in this area, and planning to put up some 20,000 units on our own or in collaboration with the relevant state and federal agencies over the next 10 years.

“Helping to build John’s house serves as an inspiration to our staff.

“What we do matters and everyone can make a difference. It’s an honour for us to be involved.”

The house was completed on Dec 14, 2019 — the result of great teamwork from all the volunteers.

As many would agree, no word could have described the moment John saw his house – all done and completed – and realised his dream has finally come true.

As the saying goes, good things come in pairs. John’s plight also caught the attention of the Fairfield By Marriott, an international hotel, located at Naim Bintulu Paragon integrated development.

The hotel promptly offered a complimentary hotel stay to John and his family in the spirit of Christmas.

To Naim, building John’s house serves as a reminder of how the company came to be — building houses for those in need in Tudan.

For John, his new home opens a new chapter for him and his family as they can now spend more time together without worrying about not having a roof over their heads.

It gives them peace of mind and the amenity of life that many take for granted.

‘I’m touched by the efforts of all the volunteers. Never in my wildest dreams have I ever imagined a company like Naim would reach out to help me fulfill the promise I made to my family a long time ago.

“My family and I are encouraged by this noble gesture to persevere and work through all the challenges we may face. And I really want to share this – with faith and perseverance, dreams do come true,” he enthused.

If anyone happens to know of any community members such as John, please e-mail to Tabung Amanah Naim, attention Ang Chin Hui via ang.ch@naim.com.my.